5th December 2025

It looks as though we’re in for a recession. It feels like it’s only 5 minutes since the last one, but here we are. And the obvious question for people in the technology industry (and the tech hiring industry) is – what will that do to the employment market for technology specialists? Will there be opportunities in recession?

I’ve worked through three recessions so far (albeit one of them, the 2001 Dot Com Bubble collapse, wasn’t officially a recession. We’ll call it a downturn). And I’ve lived through 5 that I can remember.

The first thing to be said is that recessions are not homogenous. Different situations lead to different outcomes.

So as a very broad example, the Dot Com collapse of 2001 was created by a sudden implosion of the nascent internet technology boom – and the technical jobs market saw a precipitous drop. The market blamed unwise technology investment and there was a rush away from spending on IT; a flood of candidates onto the market drove salaries down; and the combination of the two created a deep and damaging trough in the market, with long term consequences including a skills deficit years later. In stark contrast, the Covid Recession of 2020 saw very little impact on the technical hiring market. Broadly speaking, companies saw investment in technology as the answer to the problems they faced; and so after a brief shock in the March, the market returned quickly and grew at pace.

So in this article I’ve taken two approaches; one, a short history of recent recessions (starting in 2001, both because it was the first one I’ve worked through, and because that covers the last quarter century, which seems like a sensible timeframe); and two, some speculative thoughts on what might happen next.

One final caveat before I start: I’m mostly talking about permanent hiring here. The contract market is far more volatile. There will be steeper falls in opportunities and rates, and faster recoveries, because the innate flexibility of the market allows for, and indeed is built to create, fast response times. But it’s worth noting that the timing will differ from the permanent cycle; often it will move in inverse proportion, as companies seeking an exit route divert permanent budget into contract hiring to get projects delivered with minimal risk, and then try to convert contract teams to permanent teams as the market recovers to save cost and plan for the future.

So. Part 1: A short history of recessions in the 21st Century.

2001

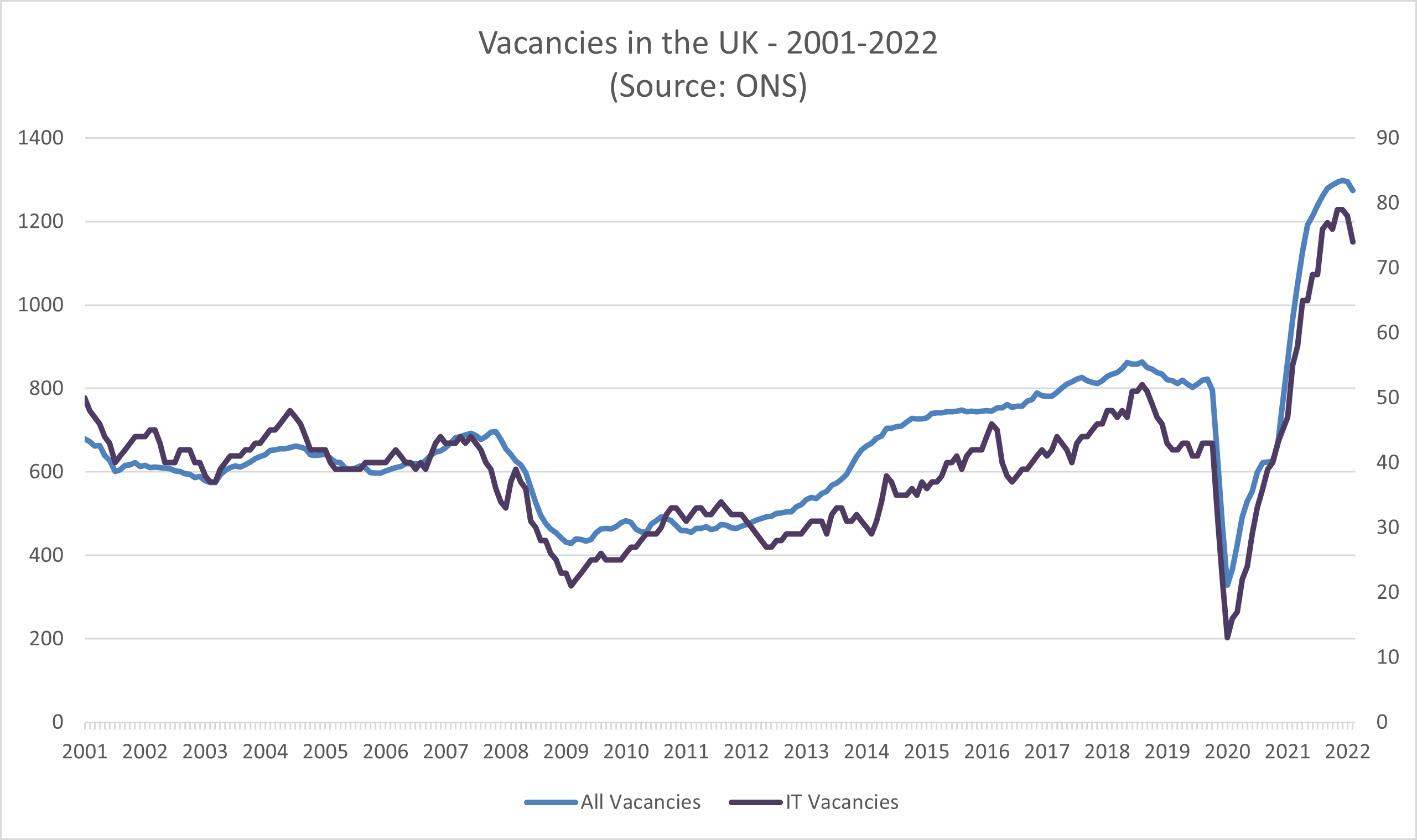

The graph above makes it clear why 2001 doesn’t count as a recession in the official records. (It doesn’t count because there weren’t two quarters of contraction, actually, but you know what I mean). But the difference between the blue line (all hiring) and the black line (tech hiring) shows why it felt like a catastrophe in the tech sector. Relative to the overall market, technology hiring collapsed; it went from a relative boom sector to one that was par at best.

There then followed a period of significant volatility. In part this was because the technology industry was in a period of profound change; the internet as we know it, mobile communications, modern computing – all were in the process of emerging from a far more rigid and business focussed client/server world. Companies emerged, succeeded, failed and moved on. There were a series of mini surges and micro recessions.

The interesting thing from my perspective is that it didn’t necessarily feel like that. It felt like a single collapse followed by a steady and unstoppable climb. And that is, in part, because hiring is only one half of the market. The absence of hiring may simply reflect a period of consolidation – hiring freeezes without layoffs are far less painful. (There’s an excellent read on that topic here). But it’s also because the initial drop was brutal. Brutal enough that it also swept away a good proportion of the recruitment market. And so with fewer competitors, there was plenty of work to go round.

Recessions are nasty.

2007

The “Great Recession” was absolutely different. It has a name of its own, for starters. Because the Great Recession was a recession in every part of the market. And it was huge. It genuinely looked for a while there like capitalism might have reached its end point. And, no question, there was a huge impact on the technology hiring market. It declined, and kept declining. Banks, a huge part of the technology hiring market, simply had no money.

And yet.

Even in the teeth of the biggest recession for decades, there was counter cyclical investment. The Great Recession was caused, ultimately, by a banking and therefore a credit crisis: but the volatility created opportunity. Just as the decline was sustained, so was the recovery. Two years of hard times was followed by seven of unparalleled growth as new companies were established, opportunities were taken, new sources of investment were found, and – most importantly – technology continued to jump forward in leaps and bounds.

2020

An investment bubble: a banking crisis and now a plague. All in the space of twenty years.

The covid recession was utterly unique. An artificial shutdown killed the jobs market in one fell swoop only for it to be rescued by – technology. It turned out that what appeared to be a pause on society was actually a sustained experiment in the possibilities of remote working. And to facilitate it, huge investments in technology were required. Better still, the government intervened in the jobs market to prevent the wave of layoffs that would surely have otherwise ensued. All in all, the extraordinary collapse in hiring that the graph above shows masks reality. In fact, the market was extremely stable, and by Q4 the hiring market was back in action and moving nicely. In April it seemed impossible to hire until face to face meetings were back: by October that seemed like the ridiculous assumption of an ancient past.

Which brings us to today. And look at that graph. 2022 has been probably the most extraordinary year of the century so far from a hiring perspective.

As I write, demand is pretty much unprecedented.

Part 2. What’s next?

There will almost certainly be a downturn of some sort. Whether it is technically a recession, and whether it really gathers pace, depends on multiple factors and I’m not an economist. But regardless, a number of things remain true:

So – things will change. Some of the salary levels and the competition in the market through 2022 have been eyebrow raising, and probably unsustainable; I know of at least one company who were offering 60% over the market in May and are now issuing profit warnings. That clearly cannot continue. Salaries will likely stabilise somewhat. Demand will probably drop to an extent; but then it would almost certainly have done so anyway in its own good time, given that continuing at unprecedented levels for the foreseeable future was unlikely.

In other words, in the technology market at least, my sense is that the market will, if anything, return to a semblance of normality. Some sectors will certainly suffer; retail will be hard work. Rail suddenly looks like a very challenging environment. But technology underpins every sector in a way that wasn’t even true in 2007; it is the mainstay of every market and so there will always be counter cyclical places to work.

I may be wrong. I may be a Pollyanna who will regret this article. But my sense is that the technology marketplace over the next couple of years will be, if not calm, a steady ship.

At Vocative we work with our clients to help them with market insights, team planning, role design and go to market strategy, and identify and secure the right people through bespoke campaigns and searches.

You can sign up for our newsletter for regular insights using the button on the bottom right.

5th December 2025

13th October 2025

3rd April 2025

Looking for opportunities in recession? Get in touch for information on opportunities in recession.

For more information on opportunities in recession, contact us, follow us on Twitter or follow us on LinkedIn.