1st October 2024

The UK has a massive skills shortage. That’s pretty much unarguable at this point – as I write this the ONS have just announced the unemployment is down to 3.5% – the lowest since 1974.

The BBC greeted the statistic as “good news” – but Reuters’ read of it is probably more realistic – they note that it is an inflationary measure, and that it’s caused by an exodus of available workers.

And although demand has fallen year on year (as also noted by Reuters), the number of available candidates for each job is at an all time low.

So the skills market is stuck. And in the technology sector, things are if anything ahead of the average. Demand is sky high (as we highlighted in last month’s blog); talent is in short supply.

Enter the government.

When I originally wrote this blog – 4 short days ago – that sentence read “enter the government with their IR35 reforms”.

But now they’ve taken their reforms and gone home, and we’re back with the status quo; and a market adrift on a tide of uncertainly and chaos.

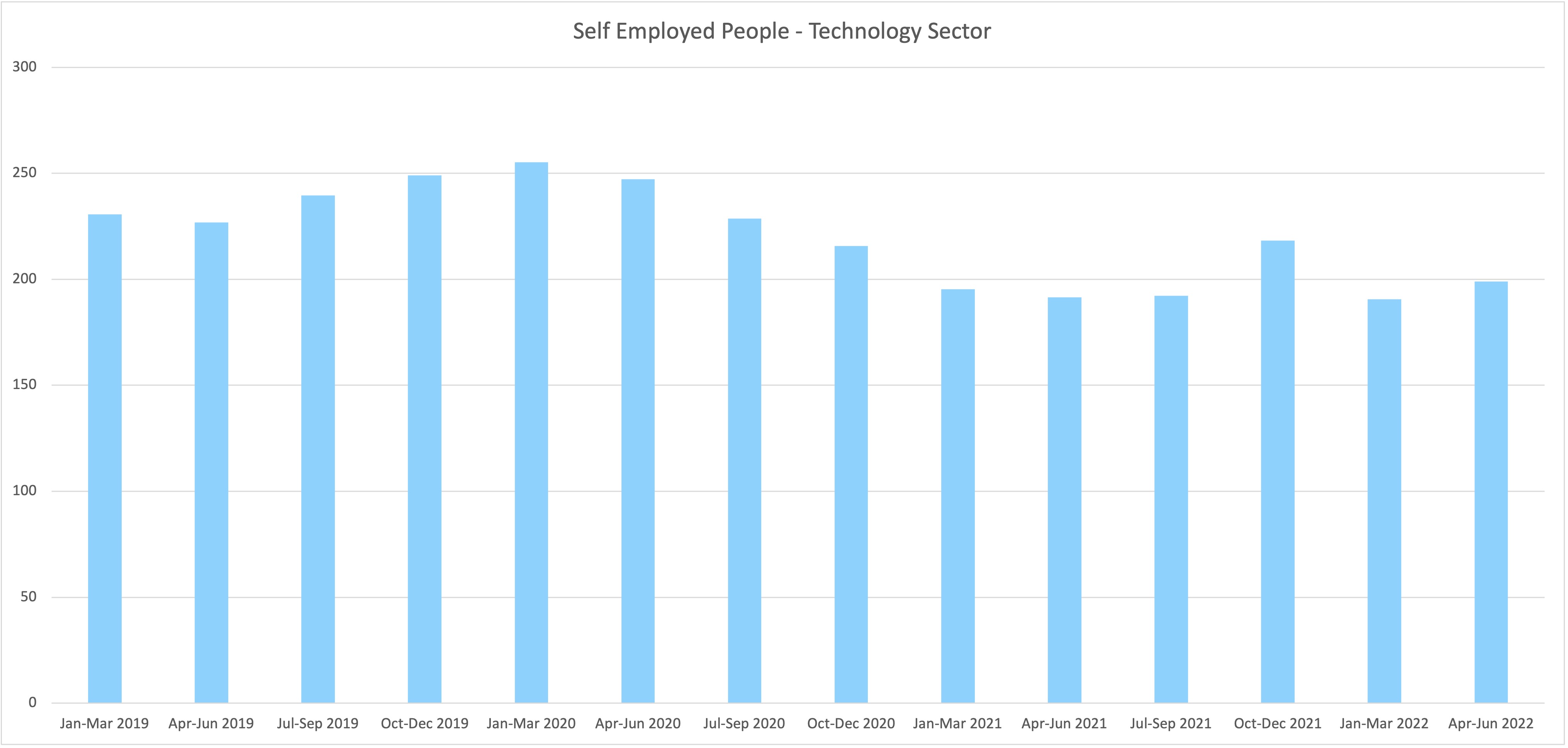

There’s no doubt that the IR35 changes that were introduced in 2017 and 2021 (in the public and private sector respectively) reduced the fluidity of the market. The number of people working as self employed fell immediately: the ONS reported almost 800,000 fewer people across the market between 2020 and 2021. The graph below shows the marked fall in the IT sector:

And it that sense, the legislation worked – HMRC wanted fewer people working as PSC Contractors, and that’s what it got. It was grossly unfair in many ways – people forced into false employment with no benefits or security but all the higher tax burden, hiring companies and agencies forced to take the risk of other companies’ tax liabilities if they wanted flexible workers – but from HMRC’s point of view, it did the job.

It would have been helpful had the government rolled those rules back.

But there are a number of immediate points to take into account:

With all that said, I think the market for contractors will shift back to an extent, even with IR35 as it is. SMEs are already flexible and nimble enough to access contractor talent that allows them to deliver work more quickly. If the governament changes its mind again and IR35 rules go back to the 2016 reality, I think we can assume that most enterprises will come back into the PSC contractor market in due course.

Adding to the demand driven by the talent shortage will be the gathering clouds of recession; in difficult markets companies become more reluctant to add full time headcount and so you’d expect contractor demand to increase anyway – ironically the government is likely to have fuelled that change just as the economy turns down. All that market uncertainty that has a negative impact on investment, counterintuitively has a positive impact on contractor demand.

Either way I doubt most companies will ever wash their hands of the determination process. Whilst the risk would have reverted to the PSC, there is a requirement for due diligence on the part of the hiring company and any agency in the supply chain, and now that pandora’s box has been opened, it’s hard to see them simply taking no notice in the way they may have done in the past. The CEST tool is totally unfit for purpose but a number of organisations (we’ve worked with QDos) have built credible and robust systems, and I’d expect them to stay as a part of the engagement process, giving relatively light touch reassurance that the tax determination has been made in a compliant way.

And by the time we see this wash out, who knows what will have happened? One of the challenges for government and business alike at the moment is that events are running ahead of policy. The government simply cannot pull the levers fast enough to act in real time.

Come September 2023, I imagine the contract market will be very, very different to the way it is now – but what of covid? How stable will the economy be? Who will be PM? Will the rules be changed again?

So many unknowns, and so much uncertainty. Which generally speaking would increase the demand for short term resource. Which takes us round this loop again……

At Vocative we work with our clients to help them with market insights, team planning, role design and go to market strategy, and identify and secure the right people through bespoke campaigns and searches.

You can sign up for our newsletter for regular insights using the button on the bottom right.

1st October 2024

15th July 2024

16th May 2024

For more information on change to IR35, contact us, follow us on Twitter or follow us on LinkedIn.